Simple Interest: Calculations and Program in Python

1. Basic

principles

Goods and services have a cost or price expressed in monetary

units. A phone costs $ 100, medical care costs $ 120. Money, by the way it is

used can be considered a good because it has physical existence, it can be

treasured, it is transported from one place to another and it serves to

facilitate the exchange since it avoids situations such as barter or

difficulties to find the point of coincidence in this exchange.

The price of money, as well as it can be conserved over time,

is expressed by the opportunity cost. The money can be retained as a

"value deposit" or it can be used to buy goods or pay for services;

the opportunity cost is in the decision to save the money or spend it, exchange

it. Time is an important element; if the possessor of the money wants to keep

it for a period, say a month, he loses the opportunity to buy the television he

wanted or go on vacation to any place; If you decide to spend it, you lose the

opportunity to receive a larger amount after the month (if you deposit it as

savings) or pay for other goods and services.

The cost of money is the interest rate, a percentage that

depends on abundance or scarcity, on the ease of obtaining it. The scarce money

will be expensive, the interest rate will be high. The interest is the

proportional part that depends on the principal or capital amount, the interest

rate and time.

2. Simple

interest. Formulas

Interest I depends proportionally on capital, rate and time

I = C * i * t

Where: C = Capital or principal (in monetary units)

i = interest rate (percentage, without units)

t = time (years or any other period of time)

There are two possibilities:

1) A needs money, B provides the desired amount. A is a

debtor (person or company) and B is a creditor or lender (Bank). After a period

A you must return the principal, principal or debt plus the interest equivalent

to the opportunity cost of the bank). The amount returned is called Amount,

Amount:

M = C + I = C + C * i * t = C (1 + i * t) = C (1 + it) = C *

FCS (1)

Where: (1 + it) = Simple capitalization factor

2) A decides to save in a bank, in which he leaves his money

for a time t and receives as compensation for his opportunity cost the rate of

i per unit of time. The opportunity cost of the saver is in the renunciation of

the use of the money while the bank can freely dispose of it for its own

banking operations. In the end, the saver receives the deposited capital plus

interest. Formula (1) is also applicable in this case.

3.

Example

Juan saves 20,000 euros in the Trampitas bank for 4 years, at

an annual rate of 5% per year. How much can you withdraw at the end of the

term?

I = C * i * t = 20,000 * 4 * 0.05 = euros * years * 1 / year =

euros

I = 4,000

M = C + I = 20,000 + 4,000 = 24,000 euros

It is important to check the coherence of units in the

calculations. The interest rate (i) has no units, Interest (I) is expressed in

monetary units.

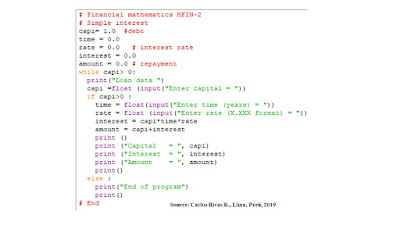

4.

Program in Python:

No hay comentarios:

Publicar un comentario